If crops were treated with Maleic Hydrazide (MH) pre-harvest, in line with best practice recommendations, you will now be facing a decision on whether to apply in- store sprout suppressants such as spearmint oil and ethylene.

Some processing crops may have been treated already. But uncertain demand heading into spring poses the question on whether to sell potatoes that are in store at the moment or keep them for longer.

The removal of CIPC this season has meant there is a large volume of potatoes receiving new sprout suppressant treatments. Most CIPC alternatives will require more of a store manager’s time to manage, but they will also often incur higher costs. So is it worth storing for longer?

Firstly, understand your costs

As mentioned, most sprout suppressant options now available are more expensive, both from a time and financial perspective. Aside the time aspect, most of the chemistry costs upwards of £3/t and multiple applications will likely increase this figure. That does not include another £2/t that you may have already spent on MH, if that was used pre-harvest, either.

It is also important, when calculating storage costs, not to forget to account for weight loss and outgrades, along with depreciation on capital investment and the cost of financing both the store and the crop as a whole.

If you need help with understanding the alternative options available, there is a whole host of information on our storage hub.

Knowing your costs is paramount when making the decision on whether to store or sell.

Next up, considering factors that could impact the market ahead

Once you know your costs to continue storing potatoes you can understand what price you need in order to make it worthwhile. There are a number of factors to consider when attempting to predict future prices.

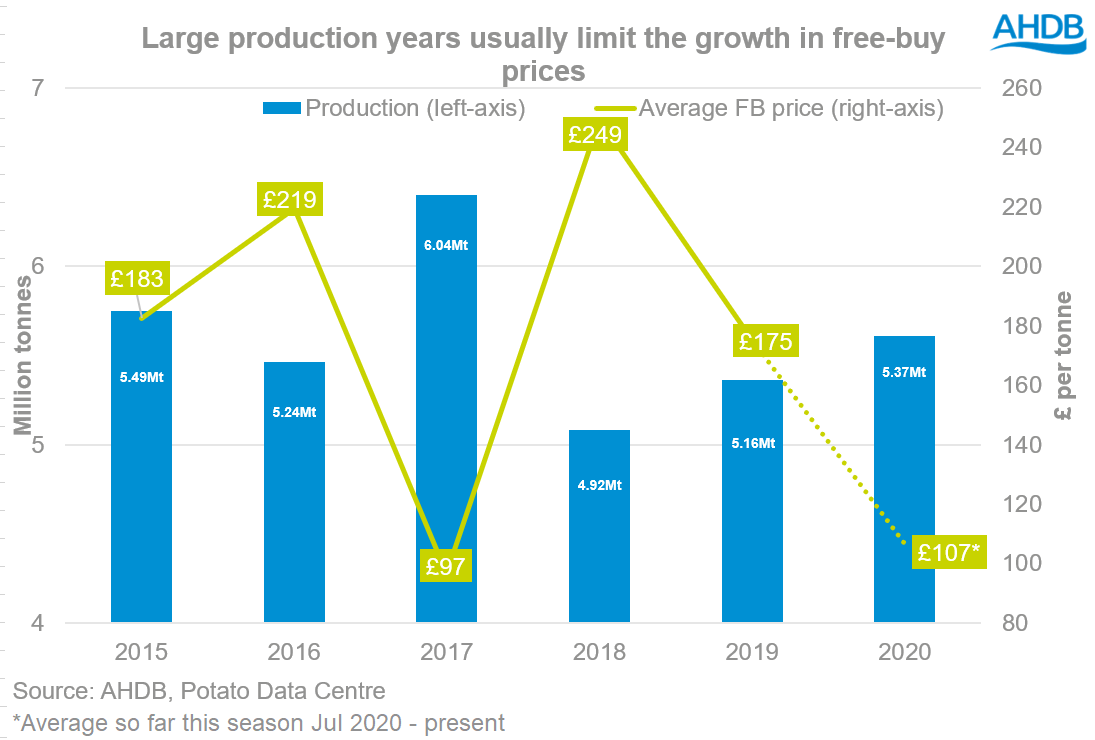

We know from past experience, that crop size can impact market prices. 2020 plantings were relatively unchanged year-on-year, with only a 2.3% drop. However, we are estimating a 4.1% rise in production (5.37Mt) based on a slight increase in yields and unharvested area reduced year-on-year.

However, critically this production isn’t the highest production in the last 6 years. Both 2015 (5.49Mt) and 2017 (6.04Mt) production exceeded this, although both had different market implications.

In 2017, when we produced a 6Mt+ crop, we saw significant pressure on free-buy prices with the average for the marketing year equating £97/t. However, the large crop in 2015, saw the average free-buy price at £183/t, seemingly less pressured.

Based on experience, a 5.37Mt crop is not “huge” and in theory would not be large enough to pressure the market throughout the year.

However, the coronavirus pandemic caused unprecedented times for the potato industry this year. Demand was stripped, and mobility and events came to a halt abruptly earlier in the year. This in turn is what has brought pressure to the market so far.

Gaining perspective on the current market situation

Demand on the free-buy market is lacklustre currently, due to the coronavirus pandemic. But optimistic hopes surrounding the rollout of a vaccine this month could offer confidence for the free-buy market going into 2021.

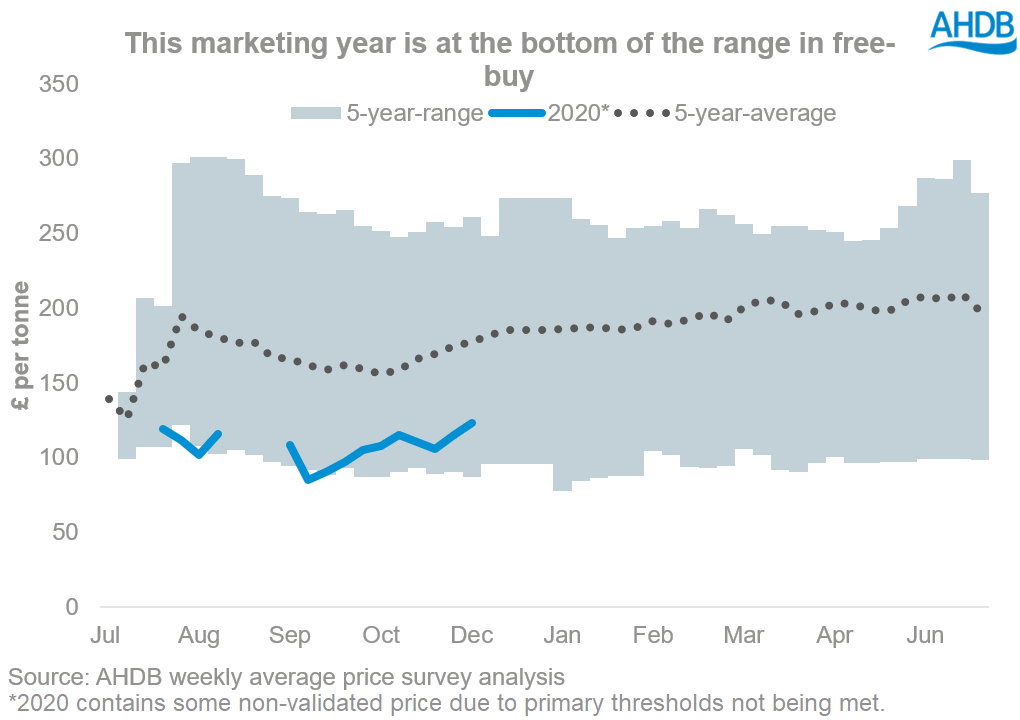

The graph above demonstrates that the average free-buy price this year is well below the 5-year average. However, despite the current situation this marketing year has not always set weekly 5-year lows, and has mostly traded above the 2017 value. Therefore, reducing prices further would not bring increased movement.

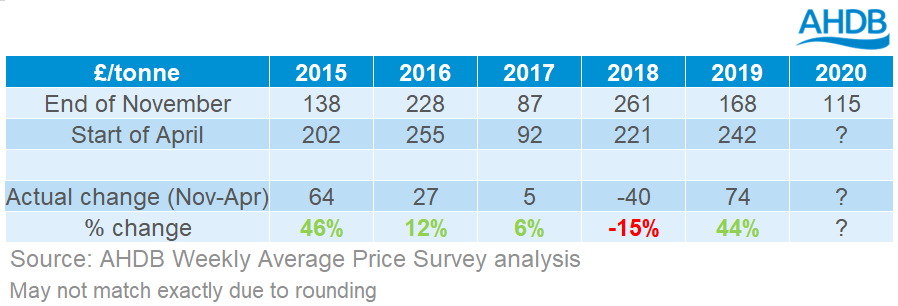

Moreover, we would expect some price lifts throughout the latter parts of the marketing year. From end of November, to start of April we tend to see rise, albeit at different levels.

In the last 5 years, this has been the case for every year apart from 2018 when the free-buy market was pressured due to starting the season exceptionally high, from drought conditions in the 2018 growing season. Also, there was relatively large volumes of lower quality material on the market by April due to the drought effects on the crop also dragging the price down.

Despite only, one in five years seeing a price fall, the question is whether the market rises enough to cover your increased costs. The average price rise over the past 5 years is £26/t. Would this be enough for you?

This week’s WAPS free-buy price quoted at £123.08/t, is near the 5-year-low and c.£60/t below the 5-year average. It is important to note though that this covers the entire industry and helps to demonstrate industry trends rather than specific sector markets.

Your end market will be key. It is unclear if large gatherings and social events will be allowed this summer despite some current optimism. This could continue to add some pressure to the processing sector and potentially the fresh bags market if movement remains somewhat restricted. However, it is expected that retail will remain strong, so you may be more likely to store packing potatoes throughout the season.

Not only is the demand prospect a driver in prices but your ability to store long term will also be. In years where quality in store deteriorates, we often see a significant divergence in pricing. As supply of sound quality potatoes tightens, premiums are generally achieved. However, with large volumes of lower quality potatoes the low end tends to drop off causing the wide spread. So, it is important not only to know your cost of storing for longer but also understanding your storage ability based on both the material currently inside but also the store itself.

Summary

- Know what your cost will be to continue storing in order to dictate what price you need to achieve

- Comparatively, the crop size is not large enough to have significant pressure on prices

- However, demand remains uncertain into the New Year and will likely differ between sectors

- Prices may not have set new record lows this year, but they have been nearing the bottom of the 5-year range. Consider the efficacy of your storage options too because prices only tend to rise throughout storage if quality maintains.