(Note: All currency conversions are approximate, based on an exchange rate of INR 82 = USD 1.)

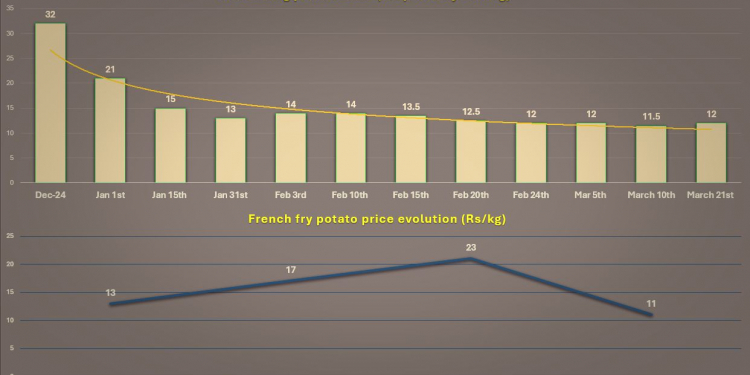

According to Tarun Teja Goli, Potato Procurement & Supply Chain Manager at Agristo India, India’s processing potato market is like “a never-ending roller coaster,” with sharp price fluctuations throughout the season. Below is an overview of key trends and factors shaping the current market situation.

- January Price Surge

In January 2023, prices for the Lady Rosetta (LR) variety—widely used in chip and flake production—skyrocketed to INR 21 per kilogram (approximately USD 0.26/kg). The main reasons were:- Increased competition among potato flake manufacturers

- Concentration of major buyers in Punjab, one of the earliest harvesting regions

- Limited supply of LR potatoes, which are highly sought-after for processing

- Price Stabilization Factors

After the January spike, prices began to level out, influenced by three primary factors:- The development of contract farming, which reduced processors’ reliance on the open market

- Higher overall production due to favorable weather conditions

- Timely harvests in all key growing regions, helping to meet demand

- Market Dynamics in February

Early February saw a brief price uptick from INR 13 (USD 0.16) to INR 14 (USD 0.17) per kilogram, but prices soon dropped again. Growers in Punjab, expecting further increases, ended up selling at even lower rates. Nevertheless, unlike previous years, the minimum price floor for processing potatoes stayed at around INR 8 per kilogram (USD 0.10/kg). - French Fry Potato Market Shift

Notable changes also affected the segment for French fry potatoes. Varieties such as Santana are now widely grown in Punjab, Uttar Pradesh, and Gujarat. This season’s higher yields have led to an oversupply, driving prices below contract levels—down to INR 11/kg (USD 0.13/kg) compared to the standard INR 12/kg (USD 0.15/kg). - Flexibility Among Flake Manufacturers

Some flake manufacturers shifted temporarily from chip varieties to French fry varieties, aiming to reduce costs. This move helped:- Strengthen prices for Lady Rosetta by reducing competition

- Stabilize the chip-processing segment

- Future Outlook

In the near term, the market for processed potato products (flakes and fries) appears relatively stable, though several risks remain:- Unpredictable weather, which can affect both yield and quality

- Expansion of production without secure raw material sourcing

- Introduction of new varieties that can reshape market dynamics and pricing

- Continued reliance on the open market without adequate planning

- Positive Trend

An increasing number of individual growers are starting to cultivate French fry varieties. According to Tarun Teja Goli, this trend helps mitigate drastic price fluctuations and offers resilience in the face of adverse weather or issues with contracted fields.

Overall, India’s processing potato market remains highly dynamic. Major processors are investing in contract farming to moderate price volatility, while growers experiment with new varieties and sales channels in pursuit of stable profits in a fluctuating market.