The 2020 lifting window has come with its own challenges, but relative to 2019 it’s certainly been more straightforward for most. As at 10 November 2020, it was estimated that just 2% of the planted area was yet to be lifted. This compares with 11% of the crop estimated to be unlifted as at 12 November 2019.

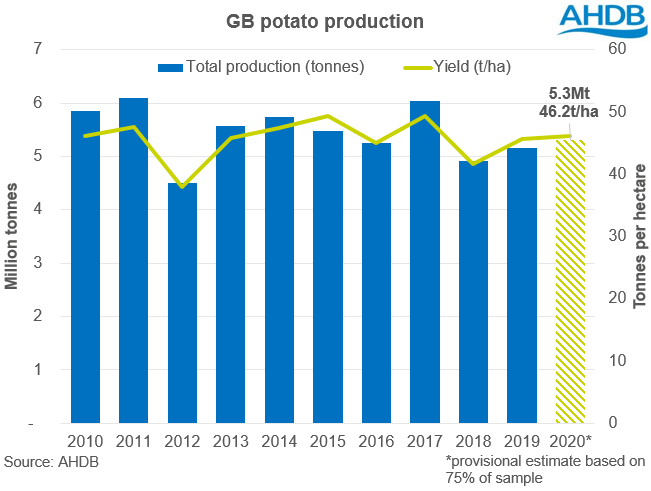

The first official GB production estimate is 5.3Mt. This is based on 75% of the sample and will be updated, along with a full breakdown, when the publishing threshold is met. Based on the current sample the average net yield is estimated at 46.2t/ha. Any unlifted crop, although abandoned by some, is still waiting to be lifted for many growers, eager to be able to get onto the land to finish their lifting campaign.

This average net yield sits in line with the five-year national average (2015-2019). Anecdotal reports suggest that yields have been somewhat variable from farm to farm, even field to field. Yet overall, crops are within farm expectations so it is not surprising that the national yield is around the five-year average.

We actually saw planted area drop by 2.3% this year, yet we are estimating a 2.8% rise in production. This is based on both a slight increase in yields year-on-year and last year recording a large area left unharvested. The unharvested area last year was estimated at 6% versus less than 1% in 2018. We would anticipate similar this year (<1%).

We could see some regional changes. For example, the East of England may potentially see a shift, experiencing both planted area declines, although only marginal (<1%), and a delay in lifting. As at 10 November, it was estimated that 2.1Kha remained unlifted in the East of England, which could translate to a reduced production in this region. 2.1Kha accounts for c.6% of this seasons total planted area in the East of England, although is just 2% of the total national area.

There will be some concerns about the quality on later lifted crop and careful store management will need to be practiced to ensure marketability of this material.

Additional information

Potato production figures are calculated using information from the Grower Panel Crop Data Survey. Currently return volumes fall below the data threshold required to release the final estimate and the current figures are based on 75% of the sample.

If you are a potato grower in GB you can join the AHDB Grower Panel Survey. The information you provide will allow us to produce key national figures on production, yields and stocks for the potato industry. You will receive £100 as a thank you for participating and providing data. To sign up please visit the Potato Data Centre.