Major crises throw sand in the machine of globalization and countries like Russia or China are then ready to protect their own interests. Fertilizers are an underestimated asset in that power game.

It fell between the folds of the news, but with spring approaching, Vladimir Putin decided again to impose an export ban on ammonium nitrate. Russia alone accounts for two-thirds of the world’s production of that specific type of fertilizer. At the beginning of November, the Russian president had already decided to impose export quotas on fertilizers. As an agricultural superpower, the Russians immediately benefit directly from the grain prices that are in the zenith.

Hamsters in capybara’s

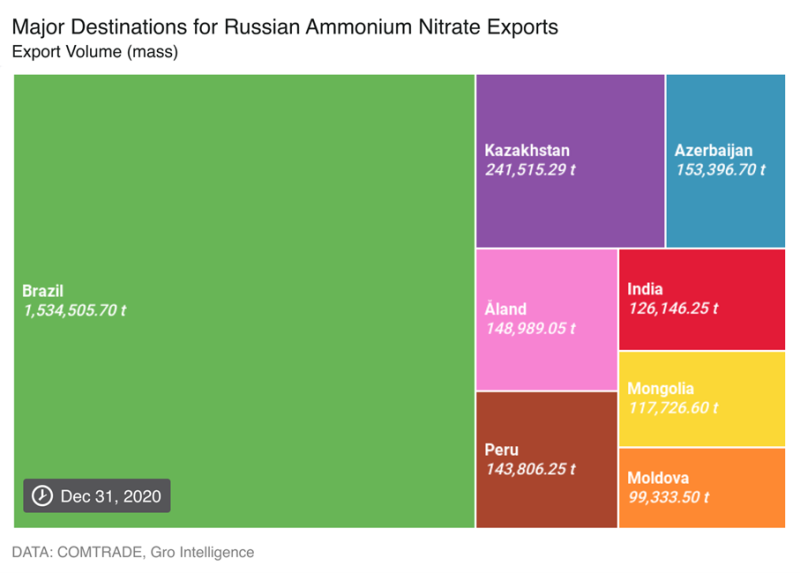

It is not the European farmers, but the Brazilian ones who are the largest buyers of the Russian ammonium nitrate. They use it for their ‘safrinha’, the second cereal crop they grow as a little brother of soybean cultivation. The maize is mainly intended for domestic consumption and is therefore a direct problem for the Brazilian population. If the Russian bear hoards, they feel it half a world away in the land of the capybara.

And so a state visit is planned next week by Brazilian strongman Jaír Bolsonaro to his equally strong Russian counterpart, much to the dismay of European leaders and US President Joe Biden. For NATO countries, it is a great diplomatic affront that the leader of a friendly nation goes on a state visit in the middle of an unprecedented military stand-off on the Ukrainian border.

Despite heavy pressure from NATO countries, Bolsonaro decided to press ahead with his visit. And it seems unlikely that he will have to sit at the same comically over-proportioned table as French President Emmanuel Macron. “We have business relations with Russia, including the subject of fertilizers,” he told the Russian news agency TASS. “Agriculture Minister Tereza Cristina will be part of the delegation and will start discussions on the interests of our agribusiness. I have no doubt that the visit will be a success.”

Heart of the European fertilizer industry

The export ban adds salt to the wounds of NATO partners, but it does not need to worry the farmers in Flanders any more. The triangle between Rotterdam, the Ruhr area and Dunkerque is the heart of the fertilizer industry in Europe. A historical legacy, because in the past ordinary coal was used for the Haber-Bosch process. “The most important building block for mineral fertilizers is ammonia,” says Peter Jaeken of BELfertil.

“The nitrogen for this is a local raw material, which we simply extract from the air. But today we extract hydrogen from natural gas. For nitrogen products, natural gas is primarily a raw material and much less an energy carrier. But of course this makes no difference for the price.”

In October last year, several European ammonia plants had to shut down their production due to high natural gas prices. Fertilizer manufacturers such as the Norwegian Yara or the German BASF usually buy their gas on the spot market, ie they have to pay for it at volatile daily prices. “The gas price represents three quarters of our production costs. Last year we bought gas for 4 euros per MWh. At the beginning of October we had to pay more than 80 euros per MWh. That puts a lot of pressure on returns,” a Yara representative testified in the Dutch newspaper Trouw last year.

“EU manufacturers have compensated for this temporary reduction in local ammonia production by moving their ammonia supplies from outside Europe, where gas prices are often lower,” says Jaeken. About three quarters of the ammonia production is used for mineral fertilizers, but the rest finds its way to industry, for example for applications in cleaning products or textiles. After the first Covid waves, the demand for these industrial applications grew much faster than for agriculture.

Also disturbed P and K

And it’s not just the prices of the N in the Holy Trinity NPK that are going through the roof. There are also extreme increases for potash and phosphate fertilizers. Because although potassium and phosphates come from mining, these substances are also used without embarrassment in the geopolitical game. Potassium carbonate is mainly in the salt mixture potash. The importance of potassium for agriculture was discovered by Justus von Liebig, but it is also used in the purification of water into potable water.

Belarus controls a fifth of the world’s potash production through the state-owned company Belaruskali. By far the largest part of exports goes through the port of Lithuania, but the West has imposed economic sanctions against the Lukashenko regime, which mainly affect Belaruski. Although Europe’s last dictatorship doesn’t care: India, China and Brazil are ready to receive the Belarusian potash. Diplomatic sources say the sanctions are actually driving Lukashenko deeper into Putin’s arms.

A classic phenomenon is that high grain prices increase the world demand for fertilizers, which means that most Flemish arable farmers don’t know what to do. “What we mainly see happening is a rather wait-and-see attitude from all parties in the market. In this way, everyone buys less at the same time, and less is stored. The situation is not very stable at the moment. Since the prices of grain crops also go up, the farmers will continue to fertilize sufficiently to increase/guarantee the yield”, says Arvesta, which guides farmers in their cultivation.