The potato market is notoriously volatile with huge yearly peaks and troughs. The volatile nature of potato pricing is, to some extent, related to the weather which is rather unpredictable. This is more so relevant in potatoes than most other UK crops because of the domestic nature of potato markets with very little global trade. This makes it hard to plan your long-term profitability.

But, how do you know what is actually a good price or a bad price? It’s all very well saying the higher the price the better but there is more to it than this.

Key points

- Falling crude oil prices benefited fuel and fertiliser input costs last year. Fuel input costs are estimated at an average of £233/ha for processing potatoes and £306/ha for fresh market potatoes.

- Fertiliser input costs are estimated to have fallen £46/ha to £376/ha for fresh potatoes. The drop for processing potatoes is slightly more at £47.00/ha, costing on average £363/ha.

- Crop protection costs increased in 2020 with the loss of several actives in recent seasons. For fresh market potatoes, the average cost is up £79/ha to £654/ha. For processing potatoes, this average increase is up £96/ha to £756/ha.

Well why is this important for me?

It is important for both a free-buy grower and a contracted grower. For those looking to grow on contract, and for many those agreements will be made in the coming weeks, it is vital to know your cost of production and your storage costs, as best as possible, before locking into a contract. The cost of production is your breakeven price for a contract with movement straight from field. However, if you are planning to sign a contract for movement later in the season the storage costs are also an important factor as the breakeven price will increase with each day of storage.

The free-buy grower is at increased risk from price fluctuation but again, knowing the breakeven price will help to make informed decisions on when to sell. It will allow for a better decision regarding whether it is worth the risk of waiting for a better price or whether a profit margin is available now; to seize the opportunity and avoid price drops in the future.

Although our cost of production figure includes storage costs. These costs are influenced by several of the index costs and so are not able to be strictly isolated. If you store long term it is important to understand your storage costs as your break-even point , which will then gradually rise. AHDB has a storage cost calculator available here that will enable you to assess costs for each option. We also took a look at storage costings post-CIPC last year in analysis that is available here.

Know your cost of production

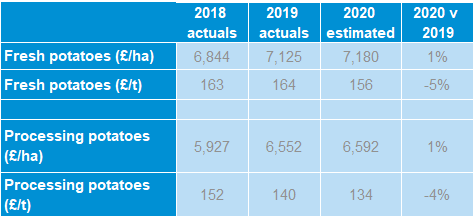

We have tools available to help you calculate your costs, as we understand every business is different and there is no “one size fits all” when it comes to the cost of production.Whilst crop protection input costs have increased, costs for fertilisers and fuel have declined but not sufficient to reduce costs per hectare. However, increased yields have meant costs are spread over more tonnes and driven a drop in the cost of production on a per tonne basis.

What input costs changed in 2020?

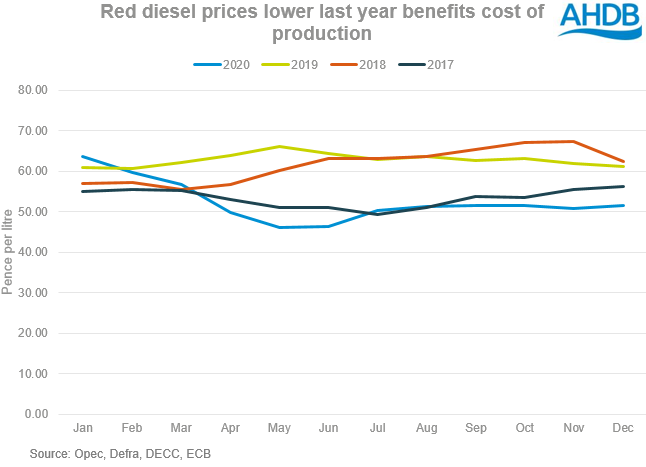

Fuel

Last year, Red diesel prices fell to their lowest average annual price since 2016 at 52.42ppl. This was driven by wider declines in crude oil prices as a result of the global lockdown measures reducing fuel demand.

Fuel input costs are estimated at an average of £233/ha for processing potatoes and £306/ha for fresh market potatoes. It must be noted that crude oil prices have already begun to recover from the low prices last year. Once lockdown measures ease later this year, we could see fuel prices further creep up again.

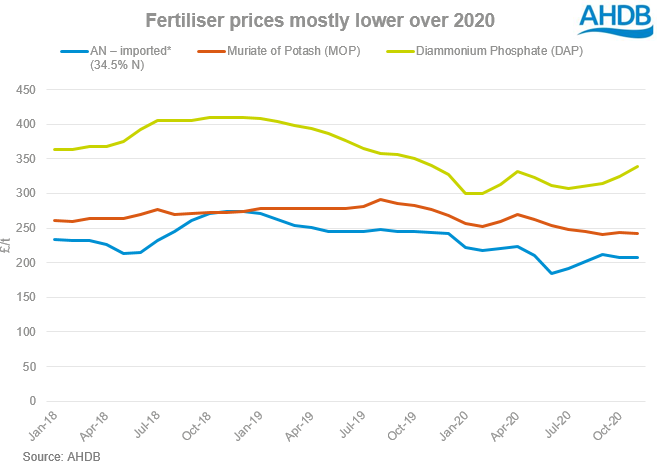

Fertiliser

The costs of fertiliser inputs have also fallen in 2020. The average price (Jan-Nov) of imported Ammonium Nitrate (34.5% N) was down £42/t from 2019 to 2020. Weaker demand alongside cheaper production costs have enabled some fertiliser prices to fall. Fertiliser input costs are estimated to have fallen £46/ha to £376/ha for fresh potatoes. The drop for processing potatoes is slightly more at £47/ha, costing onaverage an estimated £363/ha.

Fuel and fertiliser prices often change monthly according to demand, meaning purchase date and usage levels will affect the farm business impact.

Crop protection

The loss of several actives in recent years has meant average crop protection costs have increased. This has prevented a larger drop in per tonne cost of production figures. For fresh potatoes on a per hectare basis, crop protection increases £79/ha equating to a total average cost of an estimated £654.00/ha. The increase rises to £96/ha for processing potatoes to average an estimated £756/ha. The per tonne costs were mitigated by lower fuel and fertiliser costs, as well as an increased crop yield.

Looking ahead

A recovery in fuel prices in 2021 could spell an increase in cost of production. A vaccine rollout means global lockdown measures should ease this year, returning demand to crude oil markets. This too could increase costs for fertiliser production, leading to a rise in those input costs where savings may have been made in 2020. With crop protection costs likely to increase too, the overall cost of production for potatoes in 2021 could rise.

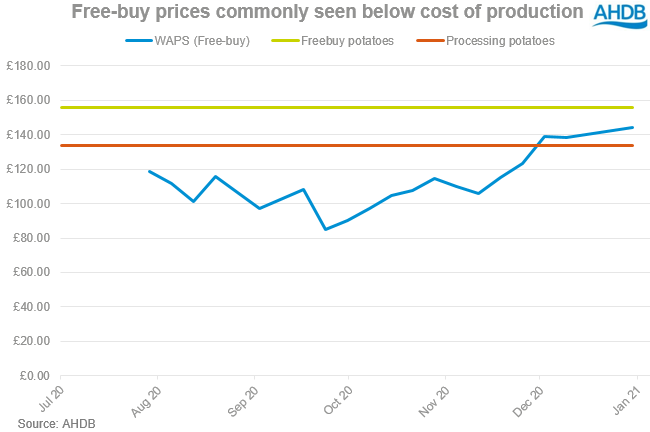

An easing of lockdown measures in the UK should spell a return in demand for potato markets. This is much needed, as many potato sectors have seen free-buy prices below the cost of production for the majority of the season so far. However, the rising infection rates at the time of writing, could keep demand levels suppressed affecting free-buy markets further.

As previously mentioned, one way growers have tried to mitigate the uncertainty in potato markets is to increase their contracted area. This trend could continue into the new season. We encourage you to use tools such as AHDB’s Farmbench which is free to use, and will calculate your own cost of production to help with marketing decisions.

- AHDB’s Farmbench will enable you to then create budgets with scenario plans based on marketing strategy.

- What is your attitude towards risk, could your contract vs freebuy split be adjusted?

Additional notes

- 2018 and 2019 figures derived from weighted average AHDB Farmbench data: ahdb.org.uk/Farmbench

- Estimated 2020 figures are based on Farmbench 2019 results and Defra Agricultural Price Index of agricultural inputs in the UK.

- Farmbench data is based on over 220 potato crop enterprise results.