In 2023, the term that defined much of the surge in food prices was “heatflation,” with drought and soaring temperatures impacting crop yields globally, from olive oil production in Spain to cabbage cultivation in South Korea.

This year, a new phenomenon emerges, directly tied to the climate crisis – let’s label it “sogflation.” While heatflation signifies price hikes due to extreme heat, sogflation arises from excessive precipitation.

A recent report released in April by the European Union’s Copernicus climate monitoring service and the World Meteorological Organisation (WMO) highlighted that 2023 witnessed a paradoxical situation in Europe. The continent faced a surge in extreme heat stress days alongside record-breaking precipitation levels, exceeding the 1991-2020 average by 7%. The deluge led to flooding impacting 1.6 million individuals.

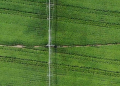

It’s evident that waterlogged fields impede productive harvests and seed planting. Potatoes bear the brunt of sogflation, with their single planting and harvest cycle making them particularly vulnerable. Adverse weather conditions in autumn 2023 halted harvesting across Europe after just three weeks as saturated soil hindered crop retrieval.

North-Western Europe Potato Growers reported that approximately 650,000 metric tons of potatoes went unharvested in the region due to rot in anaerobic conditions. This has resulted in a 20% decrease in seed availability for 2024, exacerbating concerns about potato shortages.

The compromised quality of the harvested potatoes led to a limited stock available for sale, driving prices up as packers and processors vie for supply. The looming potato scarcity poses a significant risk for Europe, a region where potatoes are a dietary staple, with an average annual consumption of about 90kg per person.

English white potato prices have surged by 81% year-over-year, reaching a historic peak, as reported by Mintec, a commodity price data provider. Market experts anticipate further price hikes until the arrival of the new crop in 2024.

In Europe, the Netherlands and Belgium, key regions for processing potato production for fries, were severely impacted, with Dutch processing potato prices hitting a record high of €370 (US$398) per metric ton in April.