U.S. Consumers Feel the Pressure of Persistent Food Inflation

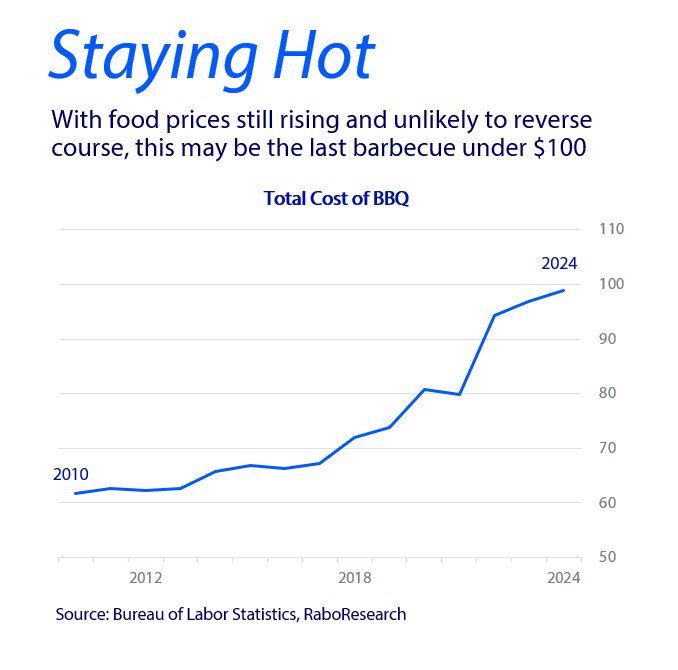

In the face of persistently high food prices, U.S. consumers are showing signs of fatigue. The 2024 Rabobank BBQ Index sheds light on the economic pressures that have weighed on American households, highlighting a 25% increase in food inflation from 2019 to the end of 2023. The first half of 2024 saw an additional, albeit smaller, inflationary uptick, tipping many consumers over the edge.

Impact on Consumer Behavior

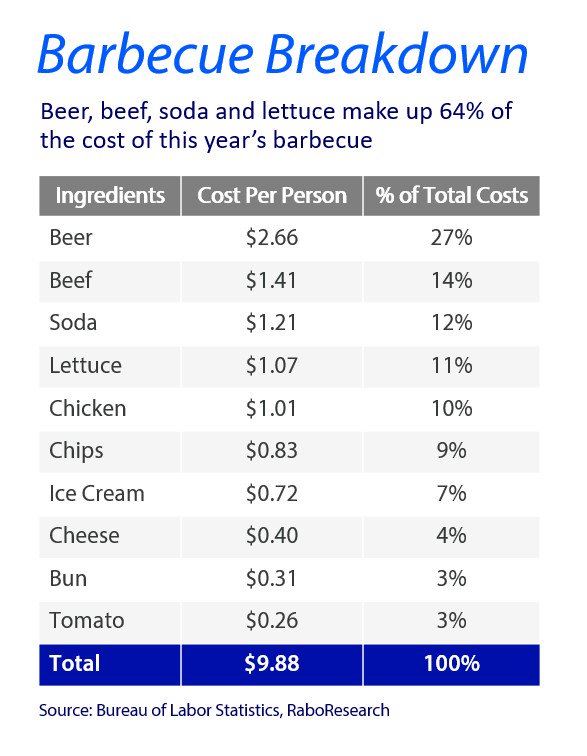

Tom Bailey, a senior consumer foods analyst at Rabobank, notes, “The consumer is waving the white flag on food inflation.” This year, the cost of hosting a Fourth of July barbecue for ten people has risen to $99, up from $97 last year and $73 in 2018. Key barbecue staples such as beer, beef, soda, and lettuce now account for 64% of the total cost.

Shift from Dining Out to Home Cooking

The rising costs have driven consumers away from dining out, where prices have increased by 4.4% annually, toward grocery stores, which have seen only a 1.1% price hike. In 2022, U.S. consumers spent over 11% of their disposable income on food, marking a 30-year high. As restaurant operators continue to raise prices, consumers are increasingly opting for home-cooked meals.

Economic Indicators and Consumer Sentiment

The broader economic trends reflect this shift in consumer behavior. Retail sales have been weaker than expected due to higher borrowing rates and inflation. Consumer sentiment, measured by the University of Michigan’s index, fell to its lowest level since November 2023. Personal finances are also under strain, with average household credit card debt rising and savings depleting.

Strategies for Cost Management

With high prices stretching budgets, consumers are becoming more strategic in their shopping habits. Many are taking advantage of promotions and opting for lower-cost alternatives. For instance, substituting chicken parts for breast meat can reduce costs, as highlighted by Christine McCracken, senior poultry analyst at Rabobank.

Trends in Meat and Beverage Costs

Beef prices continue to climb due to tighter supplies and increased demand, with consumers often switching from steaks to burgers to manage costs. The beer industry faces challenges with a glut of inventory and competition from spirits and ready-to-drink cocktails. Non-alcoholic beer is gaining popularity, contributing to a 31% rise in sales of non-alcoholic beverages in 2023.

Fresh Produce and Baked Goods

Fresh produce prices have fluctuated, with lettuce prices stabilizing after last year’s spike and potato prices dropping significantly. However, potato chip prices remain high. Bakery goods have seen stable prices, with a shift toward private-label bread and premium baked goods.

Conclusion

As Americans prepare for their Fourth of July barbecues, many are seeking bargains and adjusting their shopping strategies to cope with ongoing inflation. The Rabobank BBQ Index underscores the significant impact of food inflation on consumer behavior and highlights the adaptive measures being taken by households across the country.