The Rise of Russian Vegetable and Potato Farming

In the last two decades, Russian agriculture has experienced significant advancements, particularly in vegetable and potato production. Commercial producers have modernized practices, adopted innovative technologies, and increased output, all while navigating challenges like import dependency and climate variability.

Trends in Vegetable Production

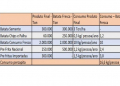

According to the agricultural consultancy Technologies of Growth, Russia produced 13.8 million tons of vegetables (excluding potatoes) in 2023. Tomatoes and cucumbers dominated, making up 35% of the total harvest. Of this, nearly 50% was grown in greenhouses—a trend driven by the country’s climate constraints in most regions.

Greenhouse farming, particularly by industrial producers, has become a key driver of growth. In 2023, industrial greenhouses accounted for 87% of the total greenhouse vegetable output, with production volumes approaching 1.7 million tons. The shift toward protected cultivation has been fueled by:

- A 60% increase in greenhouse area among commercial producers over the past 12 years.

- A 2.7-fold growth in greenhouse yields during the same period.

- Adoption of cutting-edge technologies, including automated climate control and advanced irrigation systems.

Despite these gains, the market has yet to reach saturation. Rising input costs, labor shortages, and import dependencies for greenhouse equipment and plant protection materials remain significant barriers.

Potato Farming: From Household to Commercial Scale

Potato production in Russia has mirrored the evolution seen in vegetable farming, with a marked shift from household plots to large-scale agricultural enterprises. Over the past two decades, commercial potato production has quadrupled, growing from 2.6 million tons in 2000 to 8.6 million tons in 2023.

This shift has been driven by:

- Declining production in household plots, which traditionally accounted for 95% of the sector in the early 2000s.

- Improved efficiencies and higher yields in the commercial sector, supported by modern machinery and agronomic expertise.

However, 2023 saw reduced planting areas (30,000 fewer hectares) and adverse weather conditions, leading to an estimated harvest of 7.5 million tons—down from previous years. Key potato-growing regions, such as Bryansk and Nizhny Novgorod, reported significant declines in output.

Challenges in Domestic Seed Development

One critical bottleneck for sustained growth is the slow development of domestic seed varieties. While strides have been made, creating a new variety takes 5–12 years. Currently, reliance on imported seeds and planting material is a vulnerability for both vegetable and potato production. Federal initiatives aim to bolster domestic seed development, but tangible results may not materialize until 2030 or later.

Economic Pressures and Market Dynamics

The economic landscape for Russian growers is increasingly challenging:

- Rising production costs due to inflation, logistics expenses, and higher wages.

- Dependence on imported equipment and materials, with over 70% of greenhouse systems sourced from abroad.

- Escalating prices for tomatoes and cucumbers, which rose 30%–50% in 2024 compared to 2022.

Despite these hurdles, self-sufficiency in greenhouse vegetables has improved, with per capita availability rising from 4.2 kg in 2012 to 11.6 kg in 2024.

The future of Russian vegetable and potato production hinges on overcoming current challenges. While greenhouse farming and commercial-scale operations have made impressive gains, issues like climate variability, high production costs, and import dependencies persist. Strengthening domestic seed development, increasing efficiency, and reducing reliance on imports will be critical for long-term success. With continued federal support and innovation, the sector has the potential to meet growing domestic demand and reduce vulnerabilities in the global market.