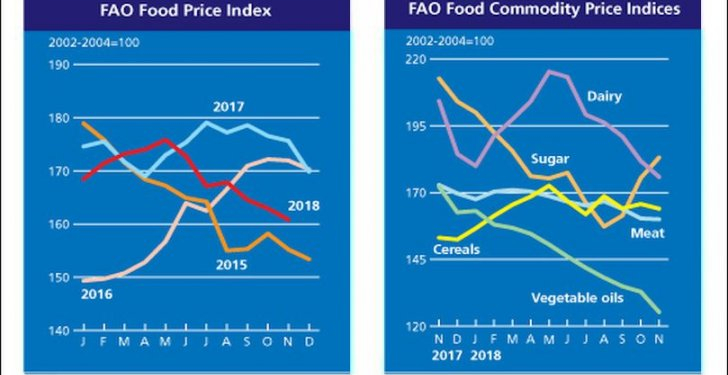

The FAO Food Price Index (FFPI) averaged 160.8 points in November 2018, down 2.1 points (1.3 percent) from October, the lowest since May 2016, and nearly 15 points (8.5 percent) below its level in the corresponding period last year.

The decline in November was led by much weaker vegetable oil, dairy and cereal prices. Meat values also fell, though slightly, while sugar prices firmed.

The FAO Cereal Price Index averaged almost 164 points in November, some 1.7 points (1.1 percent) below October and 11 points (7.1 percent) down from November 2016 average. Large nearby export supplies weighed on wheat prices while intensified export competition put downward pressure on maize quotations.

New crop arrivals continued to weigh on rice export quotations despite some support provided by demand from the Philippines and expectations of lower fragrant rice production in some key exporting countries.

The FAO Vegetable Oil Price Index averaged 125.3 points in November, down 7.6 points (5.7 percent) month-on-month, marking the tenth consecutive monthly fall and a twelve-year low.

The decline reflects weakening prices across the vegetable oil sector. International palm oil quotations posted a marked drop, fuelled by both persisting large inventories in leading exporting countries and the recent contraction in global mineral oil prices. At the same time, soy oil and sunflower oil values weakened amid, respectively, abundant supplies across the US, the EU and several emerging markets and positive production prospects in the Black Sea region.

The FAO Dairy Price Index averaged 175.8 points in November, down 6 points (3.3 percent) from October, representing the sixth consecutive month-on-month drop. At this level, the index is 13.9 percent below its value in the corresponding month last year and 18.3 percent below its highest level reached this year (in May).

In November, international price quotations of butter, cheese and Whole Milk Powder declined, driven by large stocks coupled with increased availability of export supplies, especially from New Zealand. By contrast, Skim Milk Powder prices partially recovered in November, mainly on stronger import pace by buyers seeking immediate deliveries.

The FAO Meat Price Index averaged 160 points in November, marginally lower than its slightly revised value for October, and 7.4 percent below its level in the corresponding month last year.

In November, international price quotations for poultry, pig and ovine meat continued to ease, with ovine meat falling the most, while those of bovine meat marginally recovered. Notwithstanding increased demand from Asia, ovine prices declined, underpinned by high export supplies from Oceania. Pigmeat price quotations fell for the third consecutive month, reflecting availability of large export supplies from main producing regions and continued trade restrictions imposed on account of African swine fever outbreaks. Poultry meat prices remained under pressure due to slack demand. By contrast, after five months of declines, bovine meat prices rebounded slightly, supported by somewhat limited spot supplies and firm demand from Asian markets.

The FAO Sugar Price Index averaged 183.1 points in November, up 7.7 points (4.4 percent) from October, marking the third consecutive monthly gain.

The increase in sugar price quotations mostly reflects production developments in Brazil, where according to the latest estimates, sugar output in the Center-South region is heading to a 27 percent decrease from last year. In addition, the share of sugarcane used to produce sugar is seen to have dropped to 35.8 percent from 47.4 percent in 2017, with the bulk of the cane harvest directed to ethanol production. However, the cut in Brazilian gasoline prices last month prevented sugar prices from rising even further, by diverting some sugarcane away from ethanol production.