United Kingdom potato trade saw strong performance from its processed potato sectors in the first seven months of the 2017/18 marketing season.

Trade of frozen potato products (*HS200410), by far the largest imported potato commodity of the United Kingdom, has seen strong growth both leaving and entering the UK, although imports still outweigh exports by ten-fold.

Frozen Potato Products (mostly French Fries: ‘Chips’)

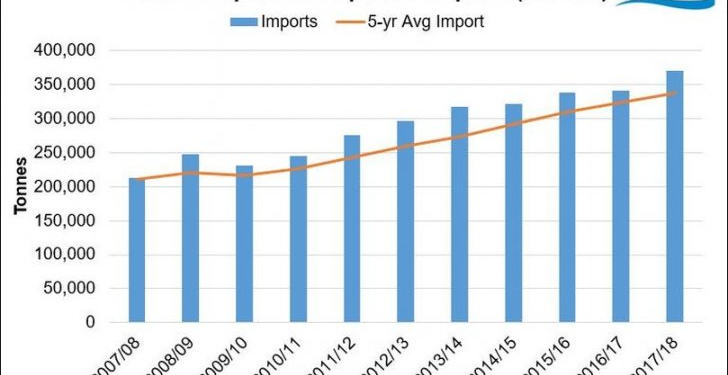

The United Kingdom is a major importer of frozen processed potato, which are typically used in the food service industry.

Imports reached 370.2Kt in the first seven months of 2017/18, an increase of 8.4% from the same period in 2016/17.

Imports between July and January have consistently increased year on year since 2009/10. This year’s increase is largely driven by a 25.2Kt increase in imports from the Netherlands taking their total to 227.2Kt, representing a 12% increase year on year.

Although the exports of frozen processed potato is a relatively small market compared to imports (less then 10%), interesting increases have been observed in the first seven months of 2017/18.

The UK exported 34.4Kt of frozen chips between July and January (2017/18), with Ireland remaining the primary destination receiving 17.9Kt and having steadily increased its demand by 28% since 2013/14. This reflects a growing market for UK exporters driven by limited processing capacity in Ireland.

Interestingly exports to the Netherlands (the nation where we receive most from) reached 9.6Kt in the first seven months of this season, increasing by 413% from the same period last year.

Brazil also appears to be an emerging market for frozen chip exports with it receiving 4.8Kt in the first seven months of the 2017/18 season. Brazil imported 214Kt of frozen chips in the first seven months of this season, an increase of 9% from the same period last year, with the bulk sourced from Argentina, Belgium and the Netherlands.

Potato Chips (‘Crisps’)

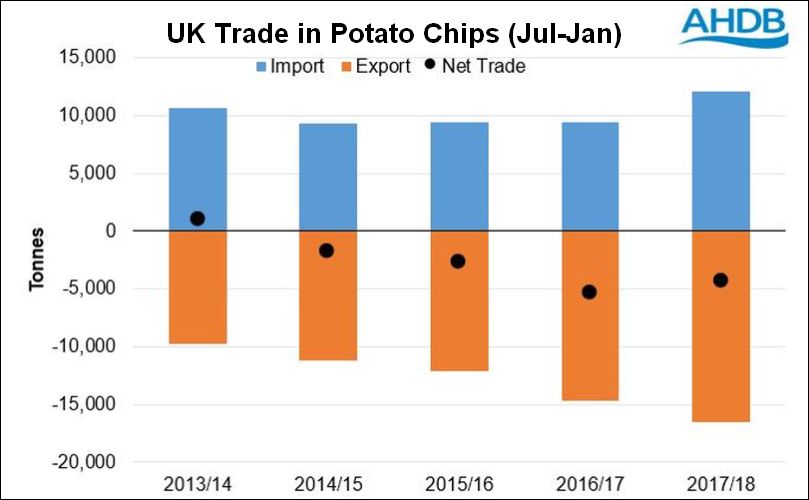

The United Kingdom is a net exporter of potato chips, with exports continuing to grow.

United Kingdom trade of Potato Chips (HS 20052020; ‘crisps’) between July and January (Source: HMRC)Exports of potato chips increased by 12% between July and January this year compared to the same period last season. This was largely driven by increased demand from Ireland who imported 9.3Kt in the first seven months of the 2017/18 season, an increase of 23% on the year.

Chips exported to Ireland have seen strong growth over the past five years, increasing by 70% since the 2013/14 season.

Meanwhile, imports of potato chips increased this season by 29% between July and January when compared to last year, reaching 12.1Kt. This follows increased imports from Ireland, Spain and France.

Canned Potatoes

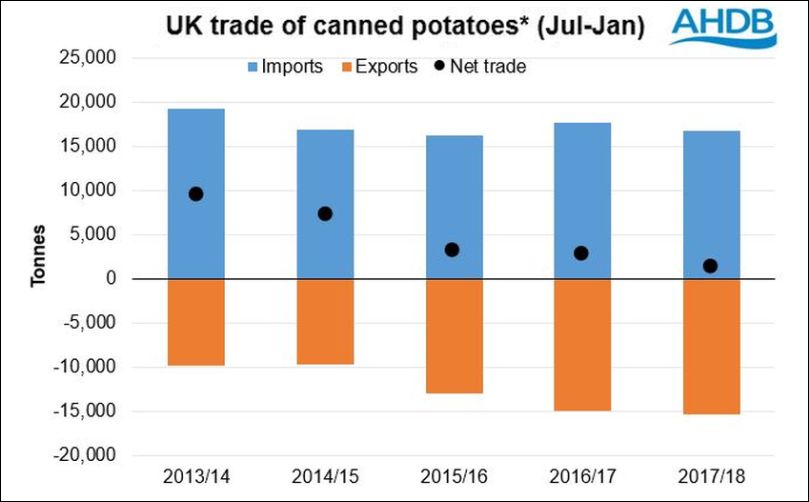

Latest data suggests that the UK is moving closer to trade parity for processed canned potatoes from its recent position as a net importer, with UK imports in the first seven months of the crop season declining by 13% and exports increasing by 56% since 2013/14 respectively.

United Kingdom trade of canned potatoes (HS20052080) between July and January. (Source: HMRC)Imports from Belgium, UK’s largest source of canned potatoes, fell 8% to 8.6Kt in the first seven months of the season when compared to the same period last year.

UK exports increased by 3% year on year to 15.4Kt. Nigeria remains the UK’s main importer of canned potatoes, increasing its imports by 23% to 6.6Kt in the first seven months of the season.