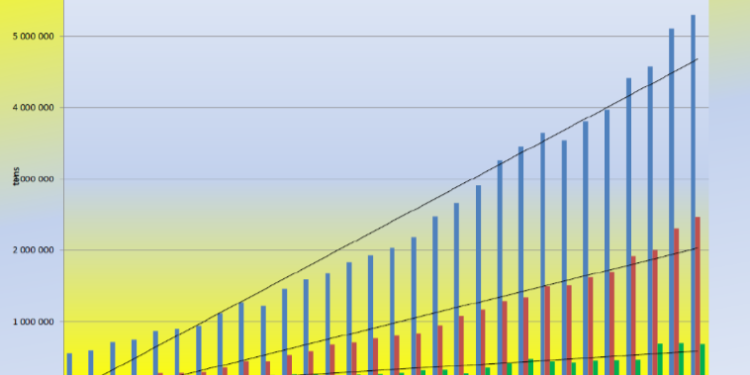

The Belgian potato processing industry produced more than 6.2 million tonnes last year processed potatoes. The sector thus sets its own record from 2019 sharper with as much as 18%. Employment in the sector increases correspondingly with the border of the 6000 workers and servants in sight.

Christophe Vermeulen, CEO of Belgapom, the Federation for the Belgian potato industry and trade: “these figures testify to the resilience, flexibility and the strength of our sector. The difficult corona years have been digested and despite a few summers with difficult harvests due to the extreme weather, the potato sector knows its

strengthen international leadership. Belgium is the land of potatoes and french fries king. With this, this sector also confirms its social and socio-economic in times when our agriculture is under constant attack.”

The numbers speak for themselves:

More than 6.2 million tonnes of potatoes, processed into fries, mashed products, chips, flakes and granules or pre-boiled potatoes.

2.8 million tons of frozen fries: a whopping 25% more than the previous record from 2019 and 31% higher than in the first Corona year 2020 257,345 tons of chilled fries: also a record. 12% more than reference year 2019 and no less than 57% more than in Corona year 2020

Chips, purees, croquettes and other specialties: 700 tons.

5912 employees and servants. That is 41% more than in 2020 (a year with a solid decrease) but also, and above all, 18% than reference year 2019

Business investments: + 300 million euros.

Destination export (world): 3,022,473 tons or 82% of production. That’s 12% more then in 2019

Destination Belgium: 608.69 tonnes or 18% of production.

However, Vermeulen nuances: “we can present excellent growth figures as a sector and we are proud of that. But there is a difference between growth and profitability. Who came in 2022 is under pressure. The Ukraine crisis caused a lack of sunflower oil and extortionate prices for alternatives. Making frozen fries is also huge energy-intensive, so there was swallowing at the invoice. In addition, costs increased for other raw materials and the packaging is more than sturdy, which means that, in addition to a record processing and turnover can also present a record cost picture: the sector spent more than three quarters of a billion euros (!) to oil, energy and packaging only. Count in addition, the increased cost of the potatoes themselves and the indexation of wages and you can imagine that it is certainly not all gold that glitters.”

Forecasts for 2023 are still a bit premature. Exports are doing well and domestic consumption remains high. The extreme cost of energy and transportation

they seem to be behind us for now. Inflation remains a concern despite forecasts this indicates stabilization. There are also concerns about finding staff.

Ambitious, growing companies need good people with the right skills, however, are increasingly hard to find. New taxes, such as litter taxes are placing more and more burdens on the processing industry. The most the sector has a lot to say about its raw material, the Belgian potato.

Christophe Vermeulen: “the evolution in agriculture is of course of great concern to us. We want a sustainable agricultural sector with investment security and perspective for the farmers and the agri-food industry. We strongly believe in the innovative power of sector. We believe in cooperation with all actors, something we do during the negotiations on the manure action plan have proven. Files are piling up: nitrogen, MAP, erosion legislation, nature Restoration Act, reduction of plant protection, de water problems… the impact on arable farming and therefore also our industry is enormous.

Where can and should we still grow potatoes within 5 years? We hope that, just as in other European countries, our policymakers are finally fully defending

take on the crown jewels of their food industry. In France, Spain or Italy, of course. However, here it remains silent, and this is incomprehensible.”

The Belgian potato processing industry in 2017-2019

| 2017 | 2018 | 2019 | |

| Number of processing plants | 18 | 19 | 19 |

| Number of workers : | 3.467 | 3.701 | 3.866 |

| Number of employees: | 943 | 1.061 | 1.135 |

| Investments: | € 305.513.247 | € 310.923.634 | € 289.219.240 |

| Raw material : | |||

| Potatoes : | 4.571.297 t. | 5.101.522 t. | 5.295.483 t. |

| Finished product : | |||

| Frozen fries : | 1.770.298 t. | 2.073.747 t. | 2.230.926 t. |

| Refrigerated fries : | 226.796 t. | 231.734 t. | 230.314 t. |

| Mashed potato products, croquettes, chips, … Flakes and others | 690.159 t. | 695.321 t. | 684.81 t. |