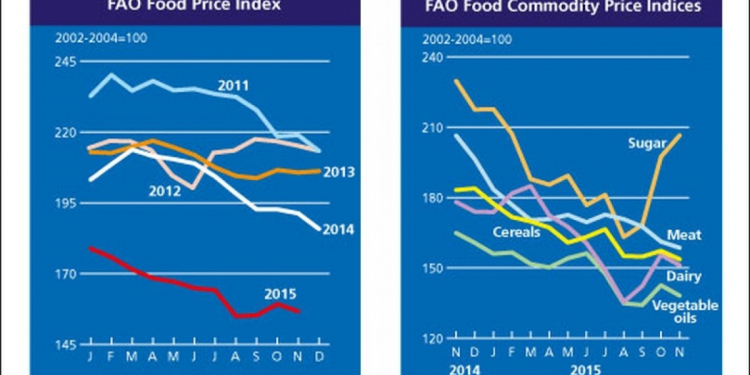

The FAO Food Price Index averaged 156.7 points in November2015, down 2.6 points (1.6 percent) from its revised October average.

Except for sugar prices, which increased for the third consecutive month, all the other commodities included in the FFPI saw their prices drop, under the pressure of a strong dollar and generally abundant supplies.

Compared to November 2014, the FFPI was about 18 percent lower, with meat values recording the sharpest fall, of 23 percent, followed by cereals and oils, which dropped by 16 percent each, dairy by 15 percent and finally sugar, which despite recent gains was still down 10 percent year-on-year.

The FAO Cereal Price Index averaged 153.7 points in November, down 3.7 points (2.3 percent) from October and the lowest level since June 2010. Coarse grains prices fell the most, under generally favourable harvesting conditions and confirmation of large supplies in the United States, the world’s largest maize producer and exporter. Wheat quotations also receded, mostly on ample global supplies and weak international demand. Likewise, despite a tightening of supplies, the rice price sub-index subsided further, on falling aromatic and Japonica quotations.

The FAO Vegetable Oil Price Index averaged 137.8 points in November, down 4.4 points (3.1 percent) from October, resuming a falling trend after a short-lived spike. Although primarily driven by weaker palm and soy oil prices, lower energy prices also contributed to the slide in the index. International palm oil quotations dropped, as sluggish global import demand coincided with larger than anticipated production in South East Asia. As for soy oil, prices fell in response to upward revisions in soy production prospects in the United States and improved planting conditions in South America.

The FAO Dairy Price Index averaged 151.1 points in November, down 4.6 points (2.9 percent) from October. After rising in September and October, limited buying interest resulted in prices falling last month, a sign that major importers have accumulated adequate stocks for their immediate needs. Quotations for butter and milk powders dropped, while those for cheese were steady. Milk production in Oceania for the current dairy year is anticipated to be lower, while output in the European Union is similar to last year.

The FAO Meat Price Index averaged 158.6 points in November, down 2.6 points (1.6 percent) from its October revised value. The October value was trimmed following lower final published prices than earlier projected for bovine meat exports from Brazil and Australia. With the exception of ovine meat, where prices rose due to limited supplies, quotations for the other categories of meat moved lower in November. For pigmeat, the weakening reflected an oversupply within the European Union, which caused both domestic and export prices to fall. For bovine meat, the fall was mainly caused by a reduced import demand in the United States, which intensified competition for market share elsewhere.

The FAO Sugar Price Index averaged 206.5 points in November, up 9.1 points (4.6 percent) from October and the highest level since February 2015. The increase was prompted by continued concerns over harvesting delays caused by excessive precipitation in the South-Central producing regions in Brazil. In addition, reports of weather-induced crop damages in other leading sugar producing countries (namely India, Thailand, South Africa, and Vietnam) lent further market support.SourceFood and Agricultural Organization of the United Nations (FAO)