In France, the number of new tractor registrations fell last year. According to figures from the Association of French Agricultural Equipment Manufacturers (Axema), a total of 37,238 tractors for agricultural use were registered for the first time in 2020 .

This corresponds to a decrease of 6.9%. The mean of the past five years was exceeded by 0.4%.

A total of 24,217 were put into service on new tractors in 2020. That was 7.5% less than in the previous year. The decline in tractors for use in orchards and viticulture was similar. In this compact class, initial registrations fell by 7.3% to 3,780.

The decline in telehandlers was even greater. Here, 4,551 machines were registered for the first time, 15.6% fewer than in 2019. The vintners showed the greatest reluctance. According to Axema, only 301 special machines for viticulture were approved for the first time last year. This corresponds to a decline of 58.4% compared to the previous year.

In contrast to viticulture, green space maintenance was evidently booming. 3,988 tractors were newly registered for this purpose. Compared to 2019, that was an increase of 24.8%.

John Deere at the helm

- The largest share of new tractors from the standard and compact class registered for the first time in 2020 came from the factories of the manufacturer John Deere, which was able to maintain its top position and expand it by 1.5 percentage points.

- New Holland lost market share for the second year in a row, but was able to maintain second place despite a decrease of 1.6 percentage points to 14.8%.

- The third-placed new tractors Fendt was able to increase its share by 1.0 percentage points to 14.3%.

- Claas gained 0.4 percentage points and increased its market share new tractor to 10.7%.

In USA the second-hand equipment is a good example

In my book, our current culture is severely short of long-term thinking. All we can see is what’s directly in front of us (most likely what is on our cell phones).

But farmers tend to roll differently. To survive the turbulent ups and downs in ag cycles over the decades, farmers are forced to think more long term.

The used equipment front is a good example. What does everyone want? Tractors in good condition, with low hours, often 10 to 20 years old. Why? The price of new equipment just keeps going up every year.

In late 2020, buyer demand for 10-to- 20-year-old tractors in nice condition shot through the roof. It was the hottest used tractor market since March 2013.

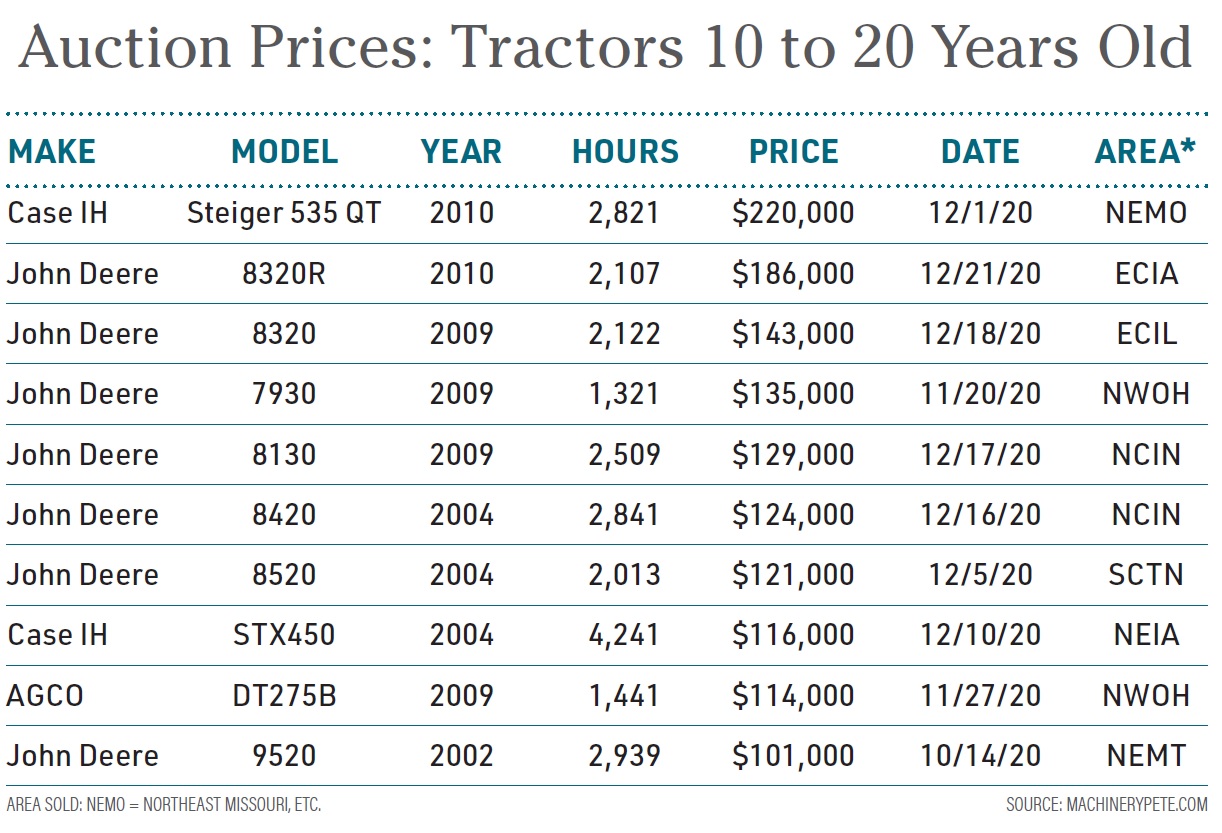

Here are a few interesting nuggets from the chart below:

- The 2009 AGCO DT275B that sold for $114,000 is a record-high price.

- The 2009 John Deere 8130 that sold for $129,000 is the second-highest price since March 2013.

- The 2010 Case IH Steiger 535 Quadtrac that sold for $220,000 is the highest price in the U.S. on a 2010 model in seven years.

Let’s think a ways down the road. What if you could position your farm on the fleet side to have the used tractors everyone wanted? That puts you in the driver’s seat when it comes time to sell or trade your machinery.

Greg Peterson shares his top takeaways from the used machinery market as we head into the end of 2020.

Key drivers in values have shaped up to be: age, condition, warranty, and personalization. No longer are geography and type of auction the main factors in auction prices.