In 2020, Flemish area consumer potatoes remained stable compared to 2019. In 2020 Flanders will have 54,230 hectares of potatoes. In the main production areas (Belgium, Germany, France, the Netherlands and the United Kingdom), potato acreage increased slightly in 2020, by 0.5% compared to 2019.

In recent years, the Flemish area of potatoes has mainly expanded to the detriment of the area of sugar beet. In Flanders, the harvest of early potatoes scored slightly better than in 2019 but significantly better than in the very dry 2018. For the late potatoes there are (on test plots) strong yield differences depending on the variety (bin, fontane, innovator) and depending on the agricultural area and of the plot.

Impact heatwave potatoes

Furthermore, due to the heat wave of August, growth on many plots has stalled. Farmers’ union expects yields that will be lower than the multi-year average, but will be significantly higher compared to the extreme year 2018. Revenue will also be lower compared to 2019. In combination with the area remained the same, the total Flemish production of consumer potatoes would be 7.2 percent lower than in 2019, when production was about 40 percent higher compared to 2018.

Price drop due to corona

Due to the corona crisis, prices on the free market have fallen sharply compared to 2019. Farmers’ union assumes a price decrease on the free market by an estimated 66 percent compared to 2019. We are currently noting that unsold potatoes from the 2019 harvest continue to weigh on the market, which means that current potato prices are dramatically low.

The corona crisis has significantly reduced the demand for potato fries, both for the domestic market and for export destinations. We note that the food service and catering activities are only slowly resuming due to the imposed corona measures and that the loss of events is clearly lagging demand behind. Since the seed potatoes had already been ordered before the corona outbreak and commitments for the leasing of potato soils had already been made, growers did not scale back their planted acreage. For the time being, it does not look like the current market situation will improve any time soon.

In Flanders, only about 40% of potatoes have been traded on the free market in recent years. The remaining 60% of the production is grown under contract. Contract prices increased by an average of about 2.5 percent in 2020 compared to 2019. Free and contract prices combined results in an expected price decrease of 25 percent. Overall, sales are expected to be 30 percent lower compared to 2019.

25

expected price drop in potatoes

30

less sales of potatoes

Not a top year for cereal market

By 2020, Flemish arable farmers will have sown less grain. For wheat and barley, the combined acreage decreased by 6 percent. Explanation is the rainfall in the autumn of 2019, which reduced the seeding of winter cereals because of poor sowing conditions.

Wheat, barley and granulated corn

The 2020 harvest could be done in good conditions. However, for wheat and barley, large variations in yields were observed depending on the type of soil and the sowing times (better yields on previous sowing). The spring drought mainly affected the yield of barley and summer cereals. There was hardly any rain from mid-March to early June 2020, causing these early grains to suffer greatly.

Due to the dry weather conditions, overall grain yields were on average 12 percent lower compared to 2019. Due to the combination of reduced acreage and lower yields, the overall Flemish grain production will be about 17 percent lower compared to 2019. The year 2020 as such is not a top year for the grain harvest, but the quality of the harvested cereals is good.

Furthermore, it seems that the yields of granulated maize will also be lower than in 2019. The rain that followed the heat wave has had a positive effect on many plots, although on the plots that bloomed a little later the heat caused damage resulting in poor stock filling.

International

In the European Union, grain production is estimated to be 5% lower than in 2019 (Copa/Cogeca estimates). The largest decrease in production occurred with wheat. Global cereal harvest was expected to increase slightly by 2020 (+2.2%) compared to 2019. As a result, cereal production will reach global consumption by 2020, which will keep world stocks stable or even record a limited increase.

In recent weeks, international grain prices have shown a very volatile picture, with average prices almost 10 percent higher than at the same time last year. This price increase is mainly explained by large purchases by some cereal-importing countries (hoarding behaviour). Farmers’ Union expects that, based on the international harvest data and on the basis of current demand, grain prices in the 2020/21 campaign will be limited (3%) higher than in 2019.

The combination of a lower Flemish grain harvest with a slightly more favourable price formation will result in a sales decrease for grain of about 13 percent compared to 2019.

17

less grain production

13

less turnover for grain

Little optimism for sugar beet

The area of sugar beet increased slightly in Flanders (+1.1%) compared to 2019. Based on the results of the recent samples, we assume an average yield of 85.6 tonnes of beets/ha to 19.4 percent sugar. This equates to a sugar production of 16.6 tonnes/ha compared to 15.1 tonnes/ha in 2019.

In terms of price formation, we cannot expect anything good. Explanation is the very sad international price of sugar which is translated into the beet price, since the change in European sugar policy has eliminated the guaranteed price. The corona crisis is also having a clear downward impact on the price of sugar. Sales of sugar beet, driven solely by higher sugar yields, are expected to be about 10 percent higher by 2020 compared to 2019. Recent years have been characterised by a continuous decline in the turnover of this sector due to falling prices and sown areas.

Europe has largely deregulated this sector. The aid measures have been completely eliminated and there are no more instruments today to deal with major shocks in the market. This has led to a sharp contraction in the sector in recent years. Over a 15-year period, sales halved.

Chicorei

The area chicory increased by 6.3 percent in 2020 compared to 2019. Revenue is estimated to be about 20 percent lower than in 2019. The cause of this is the spring drought. This cultivation is grown entirely under contract. The contract price remained unchanged. Overall, the turnover of this crop will be 16 percent lower compared to 2019.

Drought necks flax

Potatoes, cereals and sugar beet are the most important arable crops in Flanders. In addition, flax had a particularly weak year 2020. It is true that flemish flax acreage increased significantly (+22.5%) as a result of the better prices in 2019. But the drought from early March to mid-June sent harvest yields plummeting. The rain of June 2020 came too late. As a result, very little long fibre was harvested.

Farmers’ Union estimates that the total production of fibre flax will be even 30 percent lower by 2019. In 2020, the average yield on straw flax was only 4 tonnes per hectare compared to 7 tonnes per hectare in 2019. Due to the corona crisis, flax exports to China have fallen significantly.

The impact on prices is substantial. A price decrease of more than 40% is taken into account for 2020 compared to 2019. Due to the decrease in zwingel activity due to a decline in demand, flax stocks are also increasing again. Overall, sales will be almost 60 percent lower than in 2019.

30

less production flax

40

expected price decrease in flax

Good news for rapeseed

Rapeseed recorded better yields in 2020 (on average 4.2ton/ha compared to 3.5 tonnes/ha in 2019), making the realised harvest more than 14 percent higher compared to 2019. The improved yield stems solely from a normalisation of yields after the poor 2019 harvest year, when the crop suffered from the very dry metastasis period resulting in poor crop emergence. This evolution could also be seen in the eu’s main oilseed rape producing Member States. Based on current price developments, prices are expected to be at the same level as in 2019.

Hop on the shovel

Hop production is estimated to be about 15 percent lower in 2020 compared to 2019. The cultivation has clearly been adversely affected by the spring drought. Due to the drought, there are significantly fewer hop bubbles present. The corona measures have also significantly reduced the demand for beer. This applies not only to domestic demand, but also to export demand. In particular, hop exports to the UNITED Kingdom have fallen significantly. Due to the declining sales, hop stocks are increasing.

Furthermore, we note that all kinds of other crops (such as certified grass seed and certified flaxseed) have become more important by an area expansion in 2020 (+12.3% and +25.2% respectively). In particular, grass seed production is expanding due to the compulsory greening measures in the Common Agricultural Policy and the need to re-sow pastures and lawns as a result of the drought in recent years.

Arable barometer has deteriorated in harvest year 2019

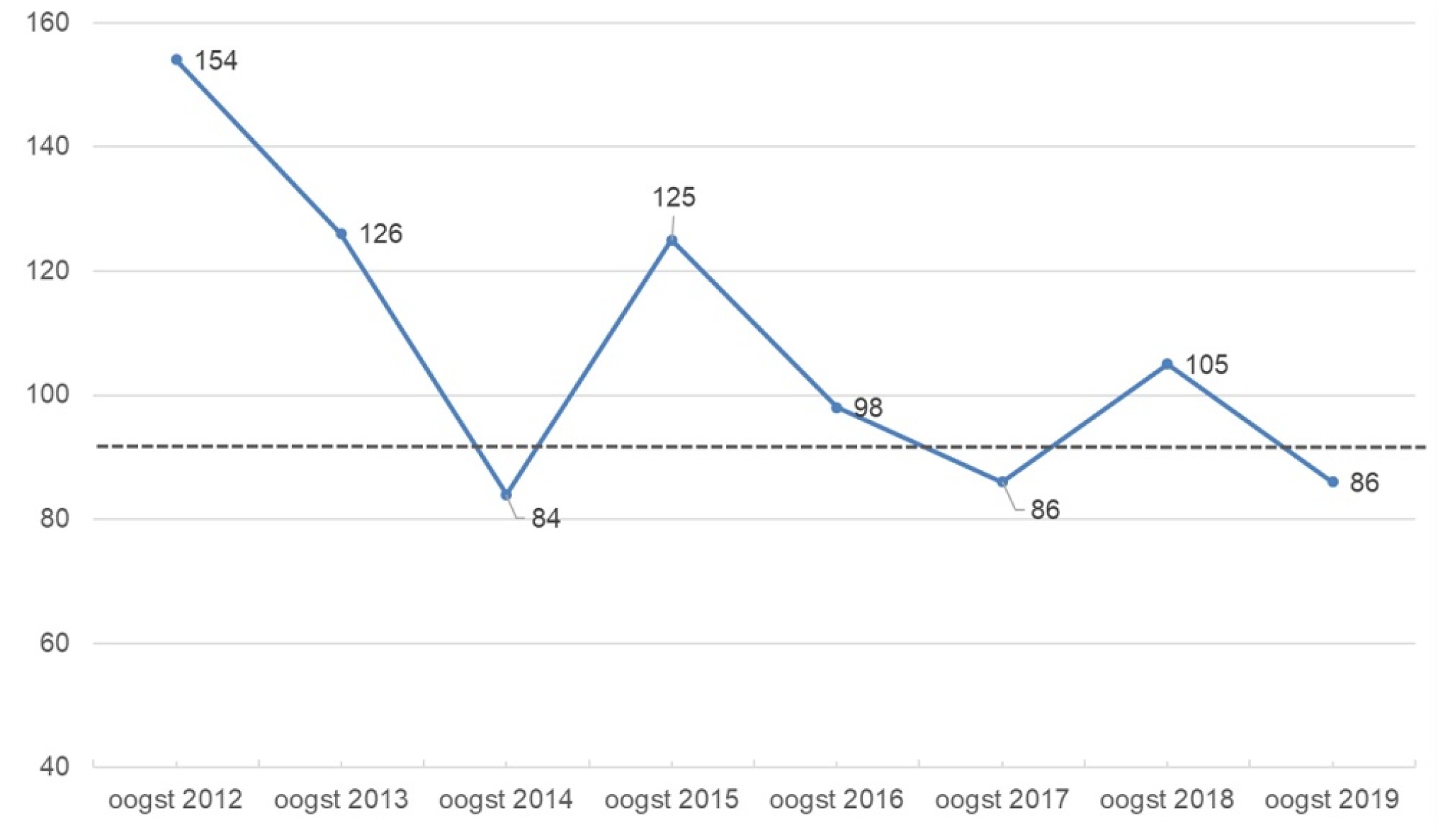

Profitability barometer for arable farming (harvest years) (reference period 2015-2019= 100)Source: Farmers’ Union

For the arable sector, the average Flemish arable farm is based on the flemish area of arable crops as the basis for calculating the index. It is a type of farm with potatoes (70% on contract and 30% free potatoes), sugar beet, cereals and granulated corn.

Farmers’ union comes for the harvest 2019 to a balance index of only 86 percent compared to the 5-year average (2015-2019). As a result, the profitability barometer is at the level of the bad arable year 2017.

The profitability barometer has large annual fluctuations. For example, the 2012 harvest clearly scored best in the analysis (good potato prices). The 2017 harvest was met with poor grain and sugar beet prices. The 2018 harvest saw a limited increase in the index compared to the 2017 harvest due to better grain prices in autumn 2018 and in the first months of 2019.

The profitability barometer for the 2019 harvest fell due to the decline in cereal prices and the sharp fall in potato prices on the free market. The hit of the corona crisis has led to a dramatic fall in prices on the free market, particularly since March 2020.